To apply for an ICICI Bank loan, you can follow these general steps:

1. *Choose the Loan Type:* Determine the type of loan you need (e.g., personal loan, home loan, car loan).

2. *Check Eligibility:* Visit the ICICI Bank website or contact a branch to check your eligibility for the chosen loan. Eligibility criteria vary based on the type of loan.

3. *Prepare Documents:* Gather the required documents, such as identity proof, address proof, income proof, and specific documents related to the type of loan you’re applying for.

4. *Visit a Branch or Apply Online:* You can apply for a loan by visiting the nearest ICICI Bank branch or by using their online application platform on their official website.

5. *Fill Application Form:* Complete the loan application form with accurate details. Ensure that you provide all the necessary information and attach the required documents.

6. *Verification Process:* ICICI Bank will verify your application and documents. They may contact you for additional information if needed.

7. *Approval:* Once your application is approved, you will receive a loan offer. Review the terms and conditions carefully before accepting.

8. *Disbursement:* After accepting the offer, the loan amount will be disbursed to your account.

It’s important to note that specific steps and requirements may vary depending on the type of loan you’re applying for. Always refer to the latest information on ICICI Bank’s official website or contact their customer service for the most accurate and up-to-date details.

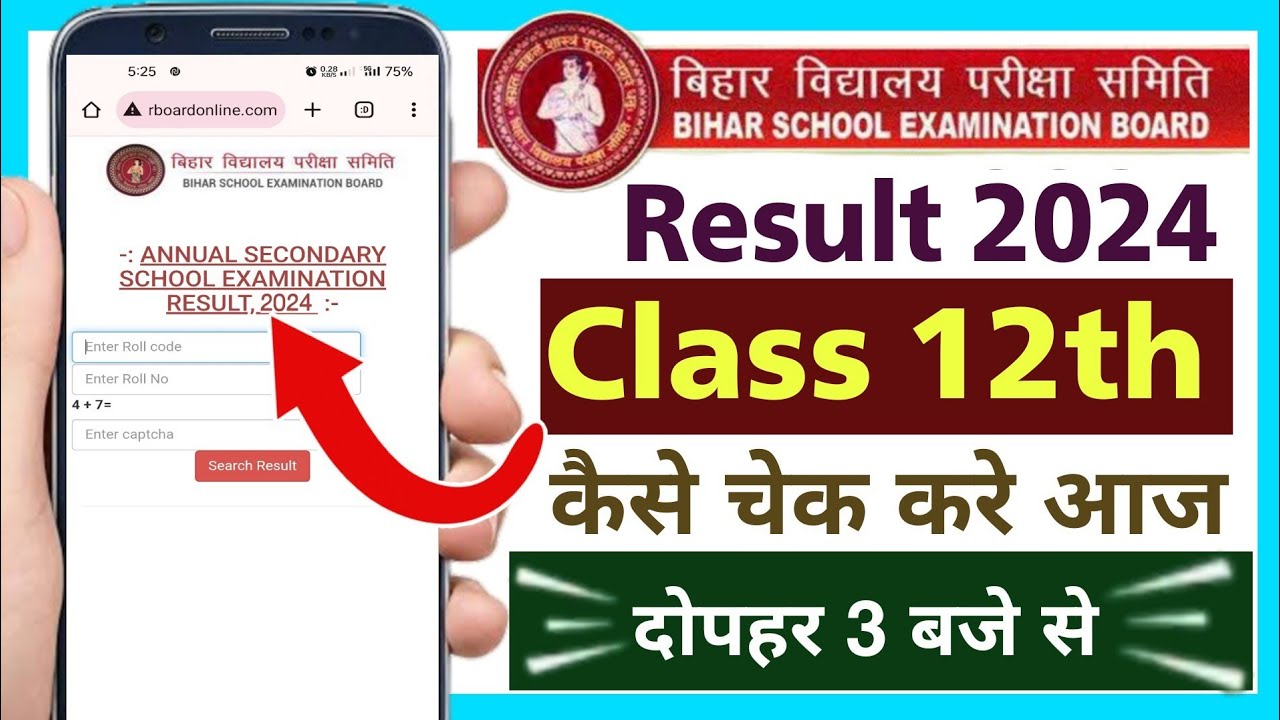

| Inter Result Check | Click Here |

| Live Checking | Click Here |

Certainly, here’s more detailed information on some common types of ICICI Bank loans:

1. *Personal Loan:*

– *Eligibility:* Salaried individuals and self-employed professionals/businessmen can apply.

– *Documents Required:* ID proof, address proof, income proof, and other specific documents.

– *Interest Rates:* Competitive interest rates based on creditworthiness.

– *Repayment:* Typically in monthly installments over a fixed tenure.

2. *Home Loan:*

*Eligibility:* Available for salaried and self-employed individuals.

– *Documents Required:* KYC documents, income proof, property documents, and others.

– *Interest Rates:* Varies based on loan amount, tenure, and type of interest rate (fixed or floating).

– *Repayment:* Flexible options, including EMIs.

3. *Car Loan:*

– *Eligibility:* Salaried and self-employed individuals.

– *Documents Required:* KYC documents, income proof, vehicle details, and others.

– *Interest Rates:* Competitive rates with variations based on factors like the car model and tenure.

– *Repayment:* Typically in equated monthly installments (EMIs).

4. *Education Loan:*

– *Eligibility:* For students pursuing higher education in India or abroad.

– *Documents Required:* Admission letter, fee structure, academic records, and others.

– *Interest Rates:* Attractive rates with flexible repayment options.

– *Repayment:* Grace period during the course and a moratorium period post-course completion.

For specific details, such as the latest interest rates, eligibility criteria, and documentation requirements, it’s advisable to visit the official ICICI Bank website or contact their customer service directly. Additionally, you can use their online loan calculators to estimate your monthly payments and plan accordingly.

Free Fire India Install : फ्री फायर इंडिया पर नई अपडेट यूजर के लिए खुशखबरी ।।

Bihar Board Inter Result 2024 बिहार बोर्ड इंटर रिजल्ट इस तरह चेक Live Check 2024